Introduction to Korean Won and US Dollar

45.6 Billion Won to USD The Korean Won (KRW) and the US Dollar (USD) play significant roles in the global financial landscape. The Won, with its origins in the late 19th century, has evolved over the years into the official currency of South Korea, symbolized by “₩”. The Won is particularly influenced by both domestic economic conditions and broader international market trends, reflecting South Korea’s robust economy and dynamic trade relationships. As a result, understanding its value relative to other currencies, especially the US Dollar, is vital.

On the other hand, the US Dollar is widely regarded as the world’s primary reserve currency. It serves as a benchmark for international trade and a standard for monetary policy across many nations. The significance of the USD stems from the strength of the U.S. economy, its extensive use in global trade, and the role it plays in stabilizing financial markets. For individuals and businesses alike, knowledge of the dollar’s exchange rate against the Won is crucial for making informed financial decisions, whether they pertain to investments, import-export activities, or personal travel plans.

Understanding the exchange rates between these two currencies is essential for financial transactions. For example, an individual or a business may need to convert funds when dealing with cross-border payments or investments. Knowing how to convert 45.6 billion won to USD not only aids in assessing financial commitments but also provides insights into market fluctuations and economic health. Currency conversion is influenced by factors such as interest rates, inflation, and geopolitical stability, which can all affect the purchasing power of one currency against another. This makes a comprehensive understanding of both the Korean Won and the US Dollar indispensable for anyone engaged in the global economy.

Current Exchange Rate: Analyzing 45.6 Billion Won to USD

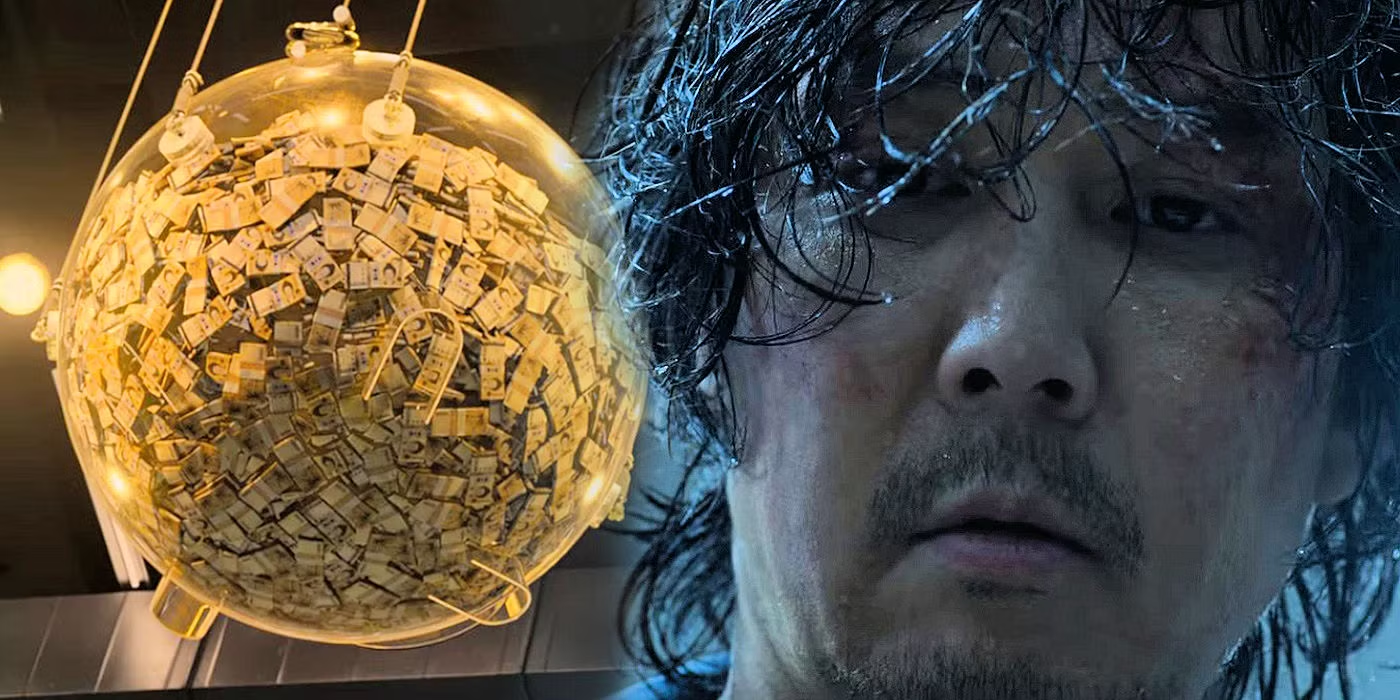

The conversion of 45.6 billion won to USD revolves around understanding the current exchange rate between the Korean Won (KRW) and the US Dollar (USD). As of October 2023, the exchange rate fluctuates but averages around 1,300 KRW to 1 USD. To convert 45.6 billion won to USD, one would divide the amount in won by the exchange rate. For instance, using the average rate, the calculation would be: 45,600,000,000 KRW / 1,300 KRW/USD, which results in approximately 35.1 million USD. However, it is crucial to note that exchange rates can vary daily due to various influencing factors.

Several elements contribute to the fluctuation of the exchange rate, including economic indicators, geopolitical stability, and interest rates. Changes in the South Korean economy, such as GDP growth, inflation rates, and employment figures, can significantly affect the value of the won and, consequently, the conversion rate to USD. Additionally, changes in US monetary policy and economic performance also exert influence on the exchange rate, making it essential for individuals and businesses engaged in international transactions to stay updated.

Historical trends further illustrate the volatility and shifts in the exchange rate between the two currencies. Over the past decade, the won has experienced periods of strength and weakness against the dollar, affected by global economic events, trade relations, and domestic fiscal policies. Understanding these historical fluctuations aids in emerging market assessment and future financial planning. Knowledge of the latest exchange rates is vital for anyone involved in currency conversion or planning international investments, as it helps ensure accurate financial assessments and transaction planning.

Practical Applications of Converting 45.6 Billion Won to USD

Currency conversion is a powerful tool in global finance, with practical applications that span various sectors, including international trade, investment opportunities, travel, and remittances. When considering the conversion of 45.6 billion won to USD, businesses and individuals may find efficient and strategic ways to leverage exchange rates to their advantage.

In the realm of international trade, converting won to USD can be essential for businesses engaging in cross-border transactions. Importing goods from countries that use the US dollar as their primary currency often necessitates converting won into USD to facilitate purchases. Understanding the current exchange rates can help companies make timely and cost-effective decisions, thus impacting profit margins positively.

Investment opportunities also present a fertile ground for currency conversion. Investors looking to diversify portfolios globally may seek to convert significant sums, such as 45.6 billion won to USD, to invest in US stocks, real estate, or other financial instruments. It is vital for these investors to grasp the market conditions that influence currency values, as fluctuations can affect their overall investment returns.

For travelers, converting currency is a necessary step to effectively manage expenses while abroad. Those considering a trip to the United States may want to convert won to USD to ensure they have sufficient funds to cover their travel costs, accommodation, and daily expenses. Understanding the best times for conversion can help travelers mitigate losses incurred from exchange rate variations.

Lastly, remittances play a crucial role for individuals sending money abroad. Whether it’s supporting family members or making donations, efficiently converting won to USD can help maximize the amount received by recipients. To effectively manage these currency conversions, individuals can shop around for better exchange rates or use online services that offer lower fees compared to traditional banks.

Future Trends: What Lies Ahead for the KRW and USD Exchange Rate

The exchange rate between the Korean Won (KRW) and the US Dollar (USD) is influenced by various dynamic factors, including economic conditions, geopolitical events, and market behaviors. As we look to the future, it is essential to analyze these components to understand possible fluctuations that could impact the KRW and its relationship with the USD. Economic forecasts suggest that the value of the KRW may experience volatility in response to both local and global market trends. For instance, if the South Korean economy continues to grow robustly, it could lead to an appreciation of the KRW, thereby affecting the conversion rate, particularly when assessing how 45.6 billion won converts to USD.

Geopolitical tensions often play a crucial role in shaping currency exchange rates. Events on the global stage, such as trade agreements or disputes, can cause sudden changes in investor sentiment, leading to fluctuations in currency values. For instance, if trade relations between the United States and Korea improve, one might expect a stronger KRW against the USD, which could impact calculations related to large transactions such as 45.6 billion won to USD. Market behaviors, including investor reactions to economic reports, interest rate changes, and inflation rates in both countries, are also significant determinants of the KRW and USD exchange rate.

Furthermore, trends in interest rates set by the Bank of Korea and the U.S. Federal Reserve will significantly influence the exchange rate. An increase in U.S. interest rates, for example, might strengthen the USD and lead to a depreciation of the KRW. This interplay hints at an ongoing need for businesses and investors to monitor both currencies closely. By preparing for potential fluctuations in the exchange rate, stakeholders can better navigate the complexities of international transactions, including substantial amounts like 45.6 billion won, promoting more informed decision-making as trends continue to evolve.